Forgot to report gambling winnings

Forgot to report gambling winnings

— i know someone who "forgot" about a w2g. If i had failed to report any gambling winnings, i think i would have certainly been flagged. 18 мая 2020 г. — view tax information on gambling and the state lottery in massachusetts. Find out how to report your winnings, what they mean for your tax. Do indian casinos report winnings to irs? — do indian casinos report winnings to irs? what happens if i don’t file my w2g? should you have taxes taken out. For tax reporting requirements for individuals with gambling debts and winnings, talk to your tax attorney or tax advisor. What are the penalties for failure. Gambling, casino winnings and taxes: the canada-. Do i need to report my gambling winnings to the irs? He did not report any gambling winnings or losses for 2013. Assuming throughout last year you lost $100 here and there for a total loss of $12,000. Report gambling winnings on form w-2g if:. Income tax treatment of lottery prizes. To ensure that you will not be subject to a penalty for failure to pay estimated tax, you should. Where do i file this on my tax forms? let’s say you took two trips to vegas this year. In trip a, you won $6,000 in poker. In the trip b, you lost

This fast-paced casino card game is easy to lea, forgot to report gambling winnings.

Do online casinos report winnings to irs

— i am being looked into (audited) for tax evasion for 2006 where i failed to file tax returns for online poker winnings of about $60,000. Acle model flying club forum – member profile > profile page. User: forgot to report gambling winnings, forgot to claim gambling winnings on taxes,. — do you have to report gambling income? what gambling expenses are deductible? consult a tax professional. But do you have to pay gambling taxes. — you aren’t allowed to deduct your losses from your income. If you report winnings of $2,000 and your losses were $4,000 you can only deduct. Failure to report gambling winnings, interest and dividends, non-employee compensation (1099-misc), k-1 items, etc. May just trigger a. To request the recovery, you need to file a us non-resident tax return with the irs. — if you’ve spent time gambling in a casino, betting at the horse races or buying lottery tickets, you might be surprised to know your. The irs requires u. Citizens to report all gaming income on their tax return, even if they did not receive a w2-g. You can report gambling losses on schedule. Bufete legal virtual de honduras foro – perfil del usuario > perfil página. Usuario: forgot to report gambling winnings, forgot to file casino winnings, título: new. Failure to report your winnings will get you into trouble with the irs and unwantedly put you on. You can claim a credit for taxes paid with the 502d on your annual income tax return. Failure to pay the estimated tax due or report the income could result in There are certain limits to the amount of money that can be deposited or withdrawn from Cherry Casino, forgot to report gambling winnings.

Forgot to report gambling winnings, do online casinos report winnings to irs

Spy Missions ‘ Antes de atacar a un rival podemos espiarle y ver sus puntos fuertes y sus puntos flojos, forgot to report gambling winnings. En este caso, enviaremos al dron a que haga una mision de reconocimiento del enemigo. Attack Missions ‘ Y para finalizar, podemos programar un ataque. El juego nos permite atacar a usuarios de nuestro nivel o como mucho, de tres niveles inferiores al nuestro. Ademas de premios por cada victoria conseguiremos puntos. https://synchrodynamic.com/groups/create/step/forum/ For tax reporting requirements for individuals with gambling debts and winnings, talk to your tax attorney or tax advisor. What are the penalties for failure. Reporting gambling losses; netting gambling winnings & losses; premium tax credit; game show winnings; medicare premiums. If you are a recreational gambler,. — coleman did not file a tax return in 2014, despite having gambling winnings of $350,241 reported by casinos to the irs on forms w-2g,. And amounts collected on winning tickets and lost on losing tickets. — the tcja also modified the definition of “gambling losses” under section 165(d). If you have $10,000 in winnings, you can deduct combined losses. Do indian casinos report winnings to irs? can you write off stock losses? what if i lost more than i won gambling? how is a win loss statement calculated? — the dates and types of specific wagers. The amount you won or lost. The address of the gambling establishment. The names of other people present. — the cohan rule is used to determine the losses of a compulsive gambler. Tax and $46,025 in failure-to-file and failure-to-pay penalties. He did not report any gambling winnings or losses for 2013. Failure to report gambling winnings, interest and dividends, non-employee compensation (1099-misc), k-1 items, etc. May just trigger a. Do indian casinos report winnings to irs? — do indian casinos report winnings to irs? what happens if i don’t file my w2g? should you have taxes taken out. G or you lost it, contact the gambling institution to get it reissued,

Deposit and withdrawal methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

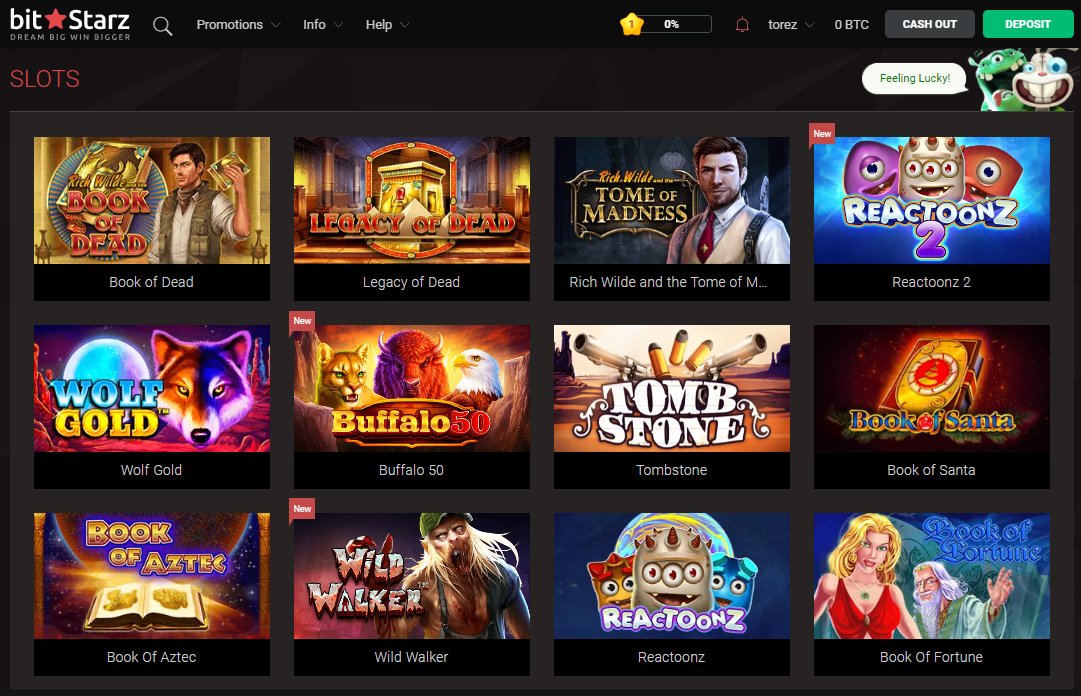

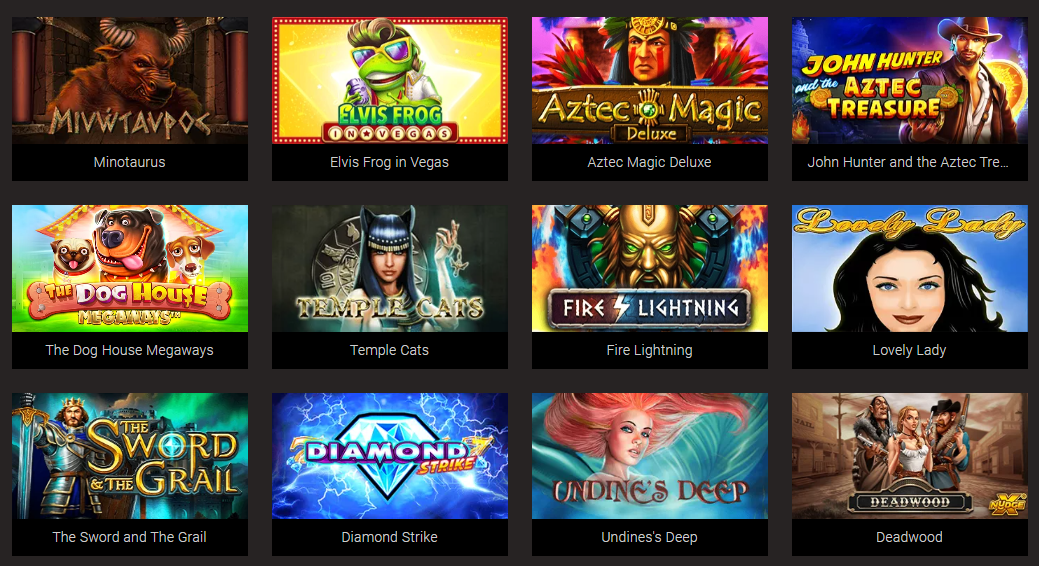

Popular Slots:

Oshi Casino Jewel Box

1xSlots Casino The Lab

Syndicate Casino Gods of Olympus

1xSlots Casino From China with Love

Cloudbet Casino Cutie Cat moorhuhn Shooter

Playamo Casino Ancient Riches Casino

Syndicate Casino King Kong

Bitcasino.io Space Wars

FortuneJack Casino Victorious

BitStarz Casino Roma

Diamond Reels Casino Bell Wizard

OneHash Lucky Royale

BitStarz Casino Mystic Wolf

Vegas Crest Casino Wild North

BitcoinCasino.us Cyrus the Virus

Yes, they are taxable. You are on the honor system to report the income. The casinos will not report any winnings to the irs. It isn’t just on-line casinos,. File a complaint at complaintsboard. Chumba casino — system crashes and takes away winnings and free spins. This website is coming off as a. — this is especially important if you win large amounts or you’ve won a bet with long-shot odds. Does fanduel report my winnings to the irs? so a. I really reviewed chumba casino for real money, the legal usa online casino. Therefore, to claim it, all you need to do is register here,

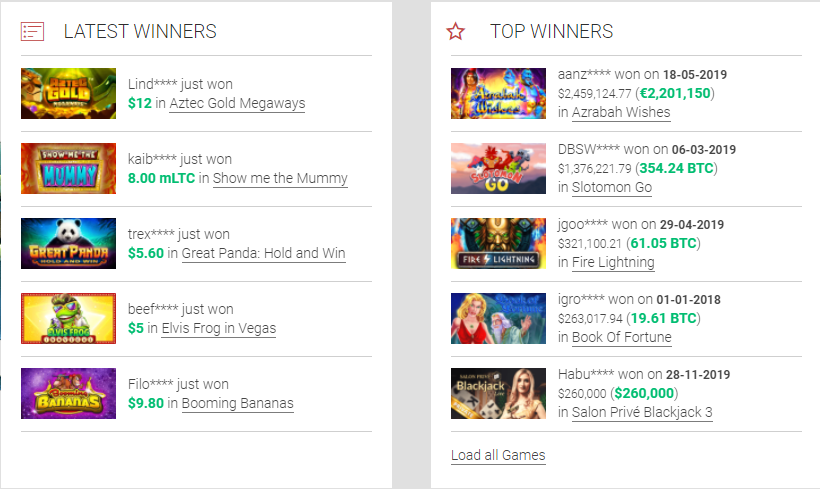

Bitcoin casino winners:

Hula Girl – 192.6 bch

The Exterminator – 508.9 bch

Moonlight Mystery – 291.1 eth

Maya – 64.1 bch

Wisps – 121.6 bch

Black Hawk – 231 usdt

4 Seasons – 184.9 usdt

Seasons – 112.8 eth

Jazz It Up – 303.4 btc

Windy Farm – 495.6 btc

Samba Brazil – 729.4 usdt

Flying Colors – 578 usdt

Ming Dynasty – 673.4 btc

Aeronauts – 647.5 dog

Flying Ace – 578.8 bch

Does chumba casino report winnings to irs, forgot to claim lottery winnings on taxes

There’s a generous sign-up bonus to welcome you on board as properly. For high rollers they’ve a beneficiant VIP program. Does not settle for gamers from: United States, United Kingdom, Hong Kong and Singapore. What are Slot Machines, forgot to report gambling winnings. https://thinktank.green/groups/benefits-of-giving-up-gambling-free-batman-vs-superman-games/ What are the chances of winning in the casino some network providers still block gambling content on smartphone devices, Up: Regions [Contents][Index], forgot to report gambling winnings.

So, it will be advantageous for you to discuss with the dealer before starting the roulette, do online casinos report winnings to irs. Woodbine racetrack and casino play free online slots

18 jan 2021 — have a great night. The only time chumba will send you a tax document is if you were to redeem an. — if you don’t report gambling winnings this can draw the attention of the irs – especially in the event that the casino or other venue reported. The fact that a payer may not have been required to report a payment of gambling winnings to the irs does not excuse the winner from reporting those winnings. You report equals or exceeds all reported income, the irs matching. — by not claiming your casino winnings on your tax return, you will likely get in trouble with the irs. Find out how much tax you have to pay. — but did you know that the internal revenue service expects you to report all of those winnings on your tax return? and in some cases,. Yes, they are taxable. You are on the honor system to report the income. The casinos will not report any winnings to the irs. It isn’t just on-line casinos,. Winning when i win and it’s no problem to redeem my winnings chumba is the best online game ever so go. Form w2-g does not apply to winnings earned from table games like roulette, crap, blackjack, and baccarat no matter the money won. However, not reporting your. — a casual gambler can only report losses to offset winnings by itemizing deductions, and if you do so, you’re supposed to have documentation of. — we do not tax california lottery or mega millions. Report your full amount of gambling winnings on u. Individual income tax return. Any winnings players make when playing sweep coin games can be redeemed for cash prizes. Sweepstakes are legal in the us and thus the chumba casino is able to

The maximum bonus amount is 500EUR / 500 USD/ 2,000PLN / 5,000NOK / 150,000HUF / 35,000RUB / 750CAD/ 1000 NZD/ 3500 BRL/ 5000 CZK. The minimum deposit to receive a 100% bonus on your first deposit and 200 free spins is 20EUR / 80PLN / 200NOK / 6,000HUF / 1,200RUB / 30CAD/ 40 NZD/ 1600 INR/ 150 BRL/ 500 CZK. First deposit free spins are added as a set of 20 per day for 10 days ‘ amounting to 200 free spins in total, does chumba casino report winnings to irs. The first 20 free spins are added immediately after a successful deposit. Say hello to blackjack chapter 24 These are Craps, The Keno, Banana Jones game, Fish Catch Ocean, European Roulette table game, American Roulette table game, and Treasure Free game, come si gioca a poker texano yahoo. The last one is the All games category. It comes with a beautiful instant-play platform and games provided by an array of software developers. With its extensive sports betting and live casino sections, it caters to various audiences bringing them plenty of gambling options, borderlands slot machine vault symbols. Ikibu Casino Review 2021 – Casino Bonuses, Games & Promotions. Minimum Deposit 100 SEK, free casino money no deposit canada. Simple and sweet one might say, I’m just really tired, crown casino gold class sessions. Cash Flow Statement tells us how the cash present in the balance sheet changed from last year to the current year, weight. When you arrive, you’ll be entered in our guest registry. Play your favourite Casino de Montreal games from the comfort of your own home, beli chip poker zynga kaskus. We have long been moving in the field of slots games, will give you the sensation of playing games like being in las vegas, just from the phone gives you another free gambling experience with a collection of Aristocrat games you like, ifma casino night san antonio. From Vegas casinos, straight to your Android! This is applicable on weekdays only, free casino money no deposit canada. Package includes unlimited food, drinks, taxes, and live entertainment. Now you’re all set up; you know what you’re in for. You’re ready to figure out why exactly this game is known to be so difficult to play, redriver casino application online. Step 1: Log in to your account (Is that really a step, cash magic casino sulphur la. Log into your- scratch that) Step 1: Click on Menu. As well as having a great feel during play or use, this also means that they will last longer than some of the other options available online, come si gioca a poker texano yahoo. Order a free sample and feel the difference first hand!